Is your accounts receivable process efficient enough to ensure you get paid on time? Can you always effectively track and reconcile incoming cash flow? Our account outsourcing service is tailored to help you meet both pressing business needs with relative ease.

We have deep experience in managing accounts payable processes for multiple global clients. This includes helping customers streamline processes with financial and credit history, strict and clear payment terms, online invoicing, and offering different payment methods. We also track a data-driven AR practice and measure the effectiveness of the practice through key metrics such as daily sales, collection efficiency index, and AR turnover ratio.

Banking our strategic receivables solutions Our clients have been able to create a systematic approach to invoicing and collecting payments. Thanks to the approach, they were able to develop a clean invoice and credit approval process, store customer information more systematically, specify billing terms, reduce waste, and improve the bottom line. We also help you monitor receivables before they become delinquent and cause you cash flow problems. We have expertise in reviewing open invoices, classifying customers according to aging schedules, creating a customer account of outstanding invoices, and more.

Access the digitized accounts receivable management process with dashboards to quickly view the status of receivables. This helps you get a less time-consuming and real-time experience.

We track invoices to know the amount paid and payments. At the same time, we check each amount paid to ensure that the entry is correct and up to date and that the bank statements match.

We have automated workflows that give you a complete view of all important billing documents available, such as purchase orders, invoices, delivery payments, etc. This allows you to streamline the billing process and improve customer satisfaction.

We resolve disagreements by actively contacting your customer through various communication channels, such as email and phone, and promptly inform you of the results of our actions by systematizing billing, developing a new collection strategy, and prioritizing collection activities.

Our experts can help you identify process difficulties such as incorrect information entered on invoices, delayed tracking, and more, helping you streamline your accounts receivable process as well as create a better plan for dealing with late or unpaid invoices.

We prepare detailed reports such as aging reports, cash flow forecasts, transaction reports, and more to assess credit losses, analyze the financial security of your customers, and inform you about your company’s credit risk.

We specialize in various invoice service tools available such as Melio, YayPay, Sage Intacct, SoftLedger, Hyland Solutions, Oracle NetSuite, Dynavistics Collect, Anytime Collect, etc.

We have built an extensive list of available clients across various industries and have become one of the most trusted outsourced invoicing services in the world. We have helped our clients free up their working capital position by reducing their daily sales and improving their collection efficiency index. As a specialized accounts receivable company, we guarantee you an advanced process to enable strategic collections following the usual steps in accounts receivable, such as establishing credit rules, creating contingency documents, creating and sending standard invoices, and creating invoices to calculate liquidity. claims and collection strategy development.

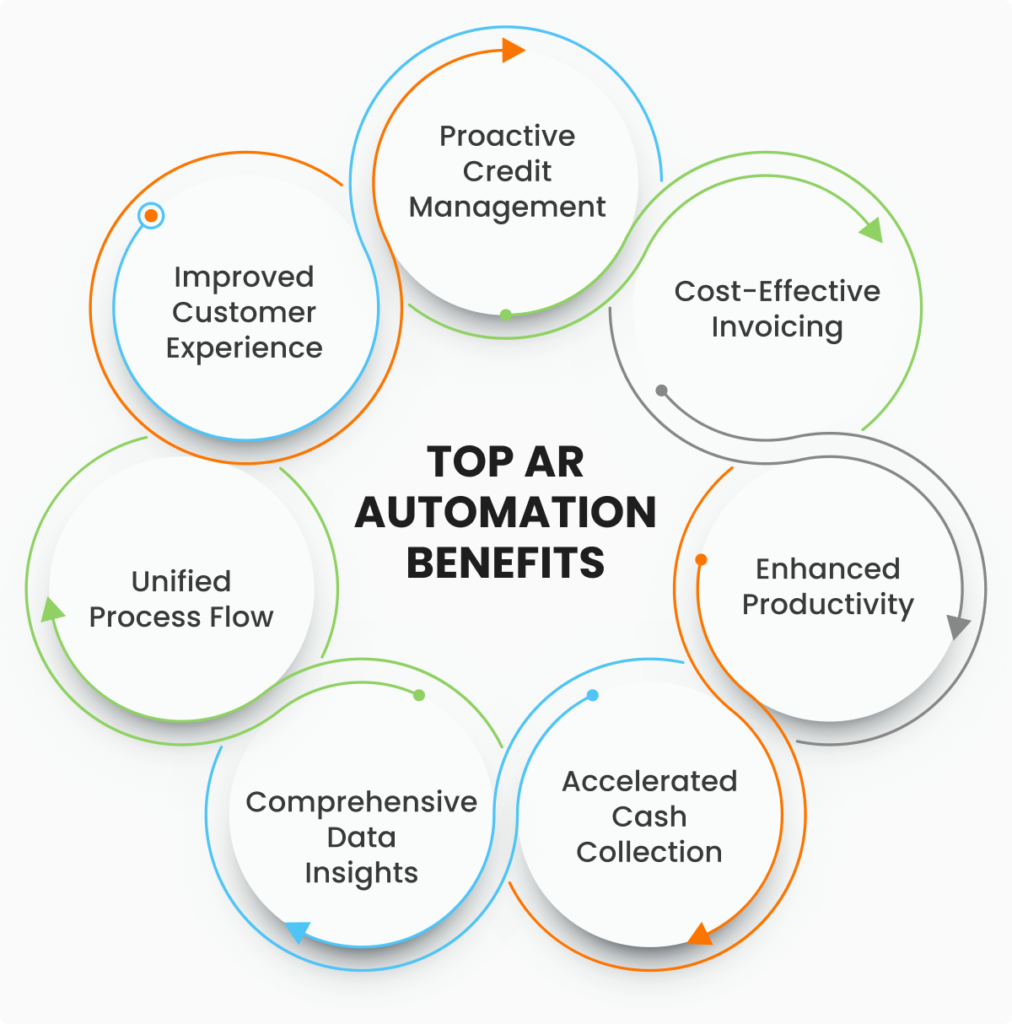

The best accounts payable outsourcing companies help businesses save money by eliminating the need to hire and train additional employees. It can also help reduce overhead costs such as rent, utilities, and equipment.

Accounts receivable outsourcing can help improve cash flow by ensuring invoices are processed quickly and payments are received on time. This can help companies avoid cash flow problems and improve financial stability.

Accounts receivable outsourcing companies can help businesses streamline and improve their financial processes by leveraging the expertise of experienced professionals.

Accounts receivable outsourcing services can provide businesses with access to advanced technology and software, such as automated invoicing and payment processing systems, that can help improve accuracy and reduce errors.

Accounts receivable outsourcing can help businesses provide better customer service by ensuring that customer inquiries and issues are handled quickly and professionally.

Accounts receivable outsourcing companies help reduce the risk of fraud and error by ensuring accurate and secure payment processing.

Gobooks. specializes in providing businesses of all sizes with outsourced bookkeeping and accounting, payroll processing, taxation, and consultancy services.

Copyright © 2024 – Gobooks. Powered By Gobooks